taxes

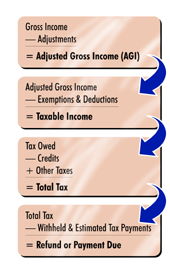

When

you pay your federal income taxes, you’re funding the cost

of keeping the U.S. government operating. The U.S. system is progressive,

which means that people who have more income pay taxes at a higher rate than

those who earn less. Under our progressive tax system, income is divided

into specific ranges or brackets, each with a separate tax rate. The part

of your income that falls into each bracket is taxed at the rate for that

bracket. The 2017 Tax Cuts and Jobs Act reformed the tax rules.

When

you pay your federal income taxes, you’re funding the cost

of keeping the U.S. government operating. The U.S. system is progressive,

which means that people who have more income pay taxes at a higher rate than

those who earn less. Under our progressive tax system, income is divided

into specific ranges or brackets, each with a separate tax rate. The part

of your income that falls into each bracket is taxed at the rate for that

bracket. The 2017 Tax Cuts and Jobs Act reformed the tax rules.  Currently

there are six tax rates: 10%, 12%, 22%, 24%, 32%, 35% and 37%. In fact, people

in upper tax brackets pay even more because they lose some of the

deductions that other taxpayers get. In addition, they may fall into the

much-dreaded Alternative Minimum Tax (AMT).

Currently

there are six tax rates: 10%, 12%, 22%, 24%, 32%, 35% and 37%. In fact, people

in upper tax brackets pay even more because they lose some of the

deductions that other taxpayers get. In addition, they may fall into the

much-dreaded Alternative Minimum Tax (AMT).

Investments you own for 12 months or longer are eligible for special capital gain treatment. When you sell them at a profit, you generate a capital gain. We have a capital gain tax rate that offers tax relief when compared to ordinary income tax.

In addition to the income tax system, we also have gift & estate taxes. This tax is imposed by federal and state governments on property that passes from one owner to another. You can leave everything to your spouse without estate taxes. Currently, federal law allows individuals to make tax-free gifts of up to $15,000 per recipient each year. You may also leave an estate valued at $11,200,000 without incurring estate taxes in 2018. The gift tax exemption equivalent is also $11,200,000.

|

|